At the heart of cryptocurrency staking lies a concept both compelling and curiously recursive: restaking. It's akin to the ancient practice of reinvesting dividends, yet deeply reinvented for the digital age. Fundamentally, restaking capitalizes on the principle of compounding - a concept celebrated by investors over centuries for its ability to exponentially amplify wealth over time. In the context of staking, restaking strategies illuminate a path for stakeholders not just to earn rewards but to exponentially enhance their potential gains by reinvesting them back into the network. This strategy, while simple in theory, unfolds a palette of considerations, risks, and methodologies upon closer inspection, embodying the nuanced dance between risk and reward that characterizes much of financial strategy.

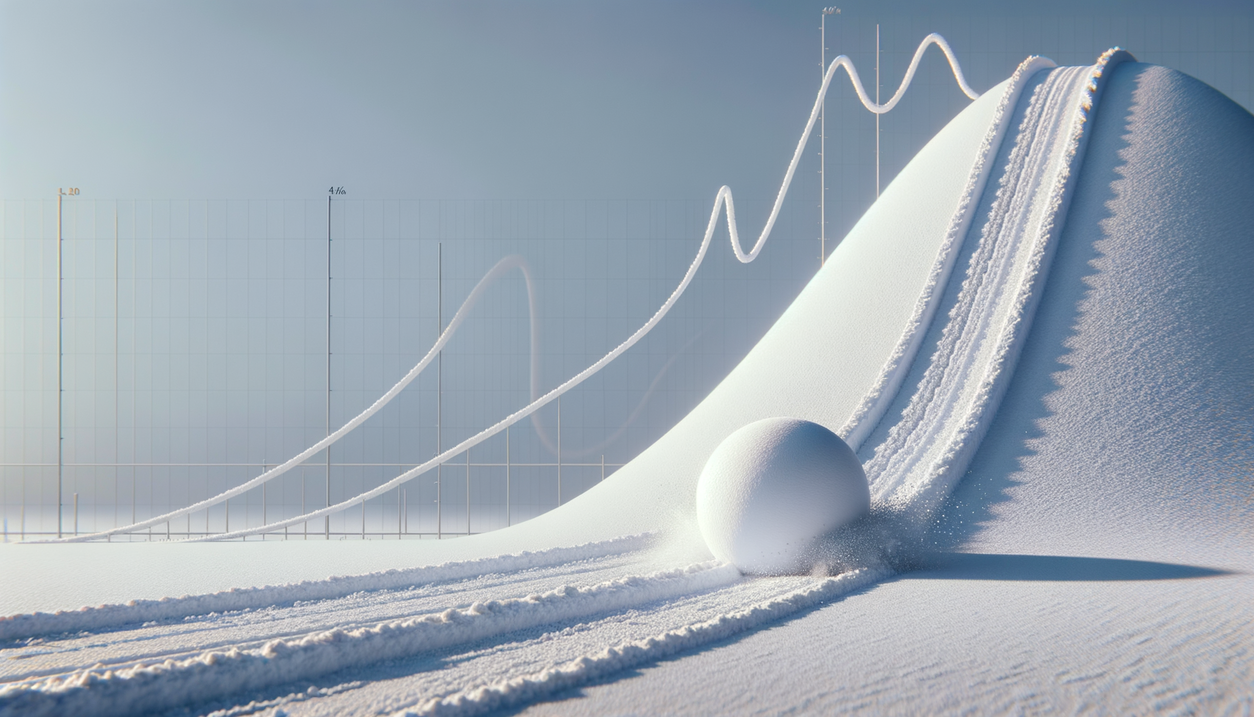

The allure of restaking is straightforward: by taking the rewards garnered from initial staking activities and staking these anew, participants can accelerate their earning potential. The magic of compounding takes center stage here, transforming what might have been linear growth into an exponential curve. It's the financial embodiment of a snowball rolling down a hill, gathering volume and momentum with every turn. In the realm of cryptocurrencies, where staking rewards can sometimes be generous, the impact of restaking can be particularly pronounced, offering an accelerated path to grow one's stake and, by extension, one's influence within the network.

However, as with all strategies that promise heightened rewards, restaking is accompanied by its spectrum of considerations and risks. The primary risk is the volatility inherent to cryptocurrency markets. The value of rewards is tethered not to a static valuation but to the market's whims. Thus, the assets accumulated through restaking are as susceptible to market downturns as to its upswings. This volatility necessitates a strategic approach to restaking, one that balances the desire for growth with the need for risk management. For instance, diversification, a cornerstone of prudent investment, can mitigate some of the risks associated with restaking by spreading investments across different cryptocurrencies or staking pools.

Beyond market volatility, restaking confronts the reality of fluctuating reward rates. As more participants enter the staking arena, the competition for rewards can intensify, potentially diluting individual rewards. This dynamic nature of staking economies demands vigilance and adaptability from those employing restaking strategies, urging them to stay abreast of network changes and to be ready to adjust their strategies in response.

Moreover, the practice of restaking intensifies the commitment to the staked platform or cryptocurrency. Since restaking involves redeploying rewards back into the network, it inherently increases one's stake and, by extension, one's exposure to the fortunes (and misfortunes) of the network. This deepened commitment must be weighed against the potential benefits, considering not only financial implications but also the evolving landscape of blockchain technologies and networks.

In writing about restaking strategies, one sheds light on the intricate interplay between growth aspirations and the multifaceted risks of the cryptocurrency domain. It's a narrative that encapsulates the advancing frontier of digital finance, where ancient principles of investment and compounding encounter the volatility and innovation of the cryptocurrency markets. Restaking embodies a proactive stance within this realm, beckoning participants not just to partake passively but to engage dynamically with the opportunities and challenges it presents.

As the landscape of cryptocurrency staking continues to evolve, fueled by technological advancements and shifts in the regulatory climate, restaking strategies will undoubtedly adapt, refined by collective experience and individual insight. In this continuous iteration, restaking stands not merely as a tactic for financial growth but as a testament to the enduring search for balance between risk and reward, a pursuit as old as finance itself, yet ever-new in the ever-changing world of cryptocurrency.