Something interesting is happening at Hyperliquid. Six companies are fighting to issue its native stablecoin, and the winner will control a revenue stream worth $220 million a year. This isn't just another crypto deal. It's BlackRock entering DeFi through the front door.

The technical architecture matters here. Ethena's proposal would back USDH with USDtb—a stablecoin issued by Anchorage Digital Bank and collateralized by BUIDL, BlackRock's tokenized money market fund. This is institutional-grade collateral: T-bills wrapped in smart contracts, issued by the world's largest asset manager.

The Economics of Extraction

To understand why this matters, you need to understand how stablecoin economics work. When you deposit USDC on Hyperliquid—and there's currently $5.6 billion sitting there—Circle earns yield on the underlying Treasury reserves. At current rates, that's about 4% annually. On $5.6 billion, that's $224 million in pure profit, extracted from the ecosystem every year.

Hyperliquid wants that money back.

The numbers are staggering. Hyperliquid processed $400 billion in perpetual futures volume last month with 11 employees. That's $36 billion per employee. For context, Coinbase does about $2 billion per employee. This efficiency comes from being fully on-chain—no matching engine servers, no database clusters, just smart contracts processing trades at sub-second latency.

The Bidding War

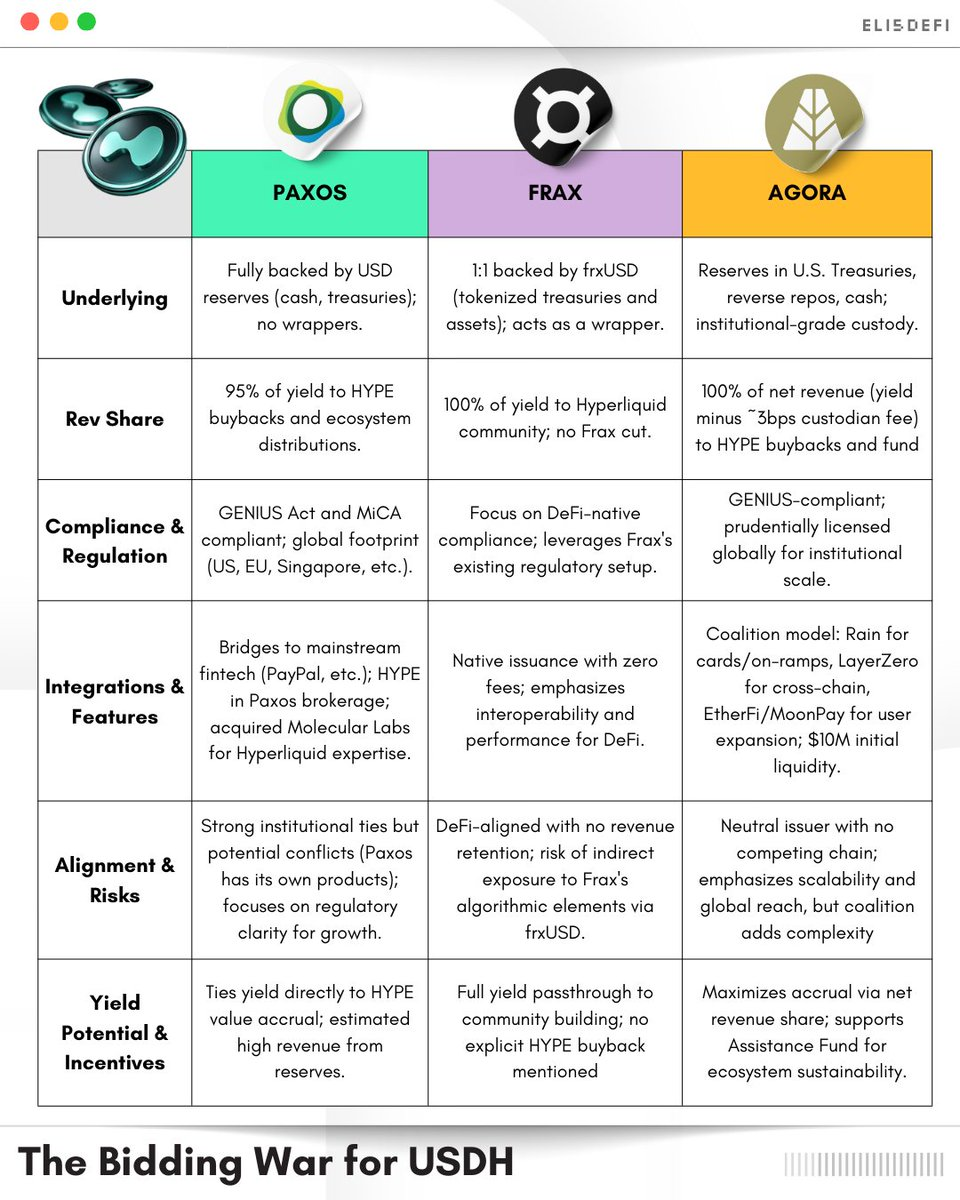

Now look at who's bidding. Paxos offered 95% revenue share with programmatic HYPE buybacks. Agora went to 100% net revenue return. Sky (formerly MakerDAO) and Frax are in the mix. These aren't startups—they're protocols managing billions in TVL.

But Ethena's proposal has an edge: explicit BlackRock backing. A BlackRock Head of Digital Assets appears in their proposal documents. This isn't a partnership; it's validation from the firm managing $10 trillion in assets.

The mechanism design is clever. USDH would be minted 1:1 against USDtb deposits. USDtb itself maintains 1:1 backing with BUIDL shares. BUIDL holds short-duration Treasury securities. It's turtles all the way down, but each turtle is federally regulated.

Token Economics

For token holders, the math is straightforward. HYPE benefits regardless of winner—every proposal commits 95%+ of revenue to the Hyperliquid ecosystem through buybacks, validator rewards, or ecosystem funds. That's $209 million annually flowing directly to HYPE value accrual mechanisms.

ENA is the leveraged bet. If Ethena wins, their stablecoin becomes core infrastructure for a $400 billion monthly volume exchange. The protocol has an approved "fee switch" that routes revenue to sENA stakers. Win the bid, and ENA becomes a cash flow token backed by one of crypto's highest-volume venues.

The migration incentives reveal how serious this is. Ethena pledged to cover all costs for converting USDC pairs to USDH pairs. That's millions in gas fees and liquidity provision, paid upfront to eliminate switching friction.

The Real Story

This isn't really about stablecoins. It's about who controls the monetary layer of decentralized finance. When BlackRock enters that conversation with tokenized T-bills, when protocols offer 100% revenue share to win deals, when a derivatives exchange does more volume than the NYSE with 11 people—you're watching the financial system rebuild itself.

The smart money is watching two tokens. HYPE for the ecosystem play—lower risk, guaranteed beneficiary. ENA for the conviction trade—higher risk, asymmetric upside if Ethena wins.

But the real story isn't the tokens. It's that we've reached the point where Larry Fink's asset management firm is competing with MakerDAO to issue currencies for permissionless derivatives exchanges. That's not convergence. That's replacement.